Founders

We want to gauge the potential of every business quickly so that we can make sensible, prompt investment decisions that are respectful of the time of founders.

Your business plan needs to provide enough information to demonstrate the strength and appeal of your team, market and technology. We need to be able to understand your business model and detailed financial projections, as well as your capital requirements, how you will use the investment funds and the milestones you will reach with this investment. Use specific information on your customers, competition, market and your sustainable competitive advantage to establish the credibility of your ambitions.

Communicate all of this effectively and concisely, include all the critical details knowing there is plenty of opportunity for elaboration later in the process.

We typically ask the following questions of every founder so answering them in your submission is a good idea.

1. What is the business or life problem that you solve?

2. How do you solve this problem (i.e. what is the technical nature of your solution)?

3. Who has this problem (i.e. who are the potential customers)?

4. What is it worth financially to a typical customer if they could solve this problem?

5. How many of these prospective customers are there in Australia? The world?

6. What is the current annual market expenditure to solve these problems in Australia? The world?

7. What alternative solutions are there to these prospects’ problems?

8. What is/are your compelling attribute(s) that will ensure your growth in this segment?

9. How will you reach these prospects and service their needs (i.e. what are the sales and delivery models)?

10. What market successes have you achieved so far (i.e. number of customers, sales revenue, etc.)?

11. How much money do you seek and what proportion of the business will the investors own?

12. Why do you need the money (i.e. what precisely are you going to spend it on)?

13. How and when will investors reach an exit? Why will your business be acquired for a large multiple of its current value and by whom?

Since we receive so many plans our policy is not to sign NDAs (non-disclosure agreements) or confidentiality agreements. Melbourne Angels pride ourselves on our practice of the highest respect and care of the confidentiality of all information received; aiming to treat you as we ourselves wish to be treated. However, you should not forward unprotected proprietary information to us. Read this article for more information.

We recognise that every deal is different and we accommodate that in our process. That process does start with standard expectations of terms you can review in our standard Shareholders Agreement.

Our guiding principle is to align the interests and expectations of all shareholders towards the common goal of realising a high order financial return within a reasonable time frame. Founders must be motivated to make a hefty return for their investors and investors must ensure that founders are suitably rewarded for their continuing efforts. Investors and founders are both taking substantial risks, together, so investment terms should be considerate of those risks and proportionally and appropriately incentivise all parties.

Founders typically approach Melbourne Angels as much for our intellectual capital as for our money. Most ventures that receive investment from Melbourne Angels will get at least one of our members as a non-executive director. Our primary purpose for that appointment is to make a substantial and sustained contribution to realising the success of the company.

One of the core strategies of successful start-up investors is to co-invest with other, likeminded investors. This creates a stronger pool of financial support within the shareholder base and delivers a deeper, broader set of intellectual capital to assist the companies succeed. Melbourne Angels routinely syndicates with other Angel groups in Australia, New Zealand, the USA and elsewhere.

Investors

Angel investing is early stage investing in private companies. It generally is the first round of formal, external funding for startup companies which have previously received investment from founders, family, friends and accelerators. Due to the early stage of the companies being financed, often pre-revenue, Angel investing is very risky and typically illiquid for five to ten years.

Angel investors are financially secure individuals who invest in high risk, early stage ventures by reserving a portion of their total investment portfolios to provide emerging companies with seed and start-up capital through direct, private investments. Melbourne Angels members prefer equity investments. Due to the high risk and illiquid nature of these investments, Angel investors seek appropriate, risk-adjusted returns substantially higher than those typical in public markets. Most Angels are active investors – they contribute their time, experience and networks to enhance the company’s probability of success – because they enjoy the thrill of helping entrepreneurs grow their businesses. To maximize the value added, most Angels specialise in industries or technologies they understand, and invest only in companies within close geographic proximity.

A collection of individual Angel Investors who combine under a common brand with defined rules of membership and conduct to collectively identify, review, select, evaluate, invest in and exit from Angel investments. Angel groups vary in structure, focus and formality.

A typical Angel group’s investment ranges widely from $50,000 to $500,000 per deal, depending on how many group members are interested in the deal and the right level of funding for any given venture. While no two Angel groups operate exactly alike, most Angel groups maintain a local or regional geographic focus in order to maximize members’ ability to actively engage in the growth of their investments. Angel groups have processes for collecting and evaluating investment opportunities then typically organize regular meetings for members to hear pitches from companies selected to present. If the group (or members of the group) decides to proceed, interested members commonly collaborate on due diligence and deal negotiation. In most group’s investments are made directly by individual members while some groups pool investments through a persistent investment vehicle. Most groups apply standard terms to their investments, with some flexibility to negotiate.

Angel investing is an extremely risky asset class and should not be pursued if the investor is unable to absorb a complete loss of his or her investment. Each member of Melbourne Angels makes an independent investment decision on when and how much to invest. In general, Angel investments are made as a minimum of $10,000 and Melbourne Angels expects all members to invest $40,000 a year in Melbourne Angels deals.

Angel investing is a risky proposition. As with any investing, that risk can be mitigated by diversifying across a broad and deep portfolio of Angel investments. Making better investment decisions and improving investment expertise can both mitigate risk. Melbourne Angels assists with these through its collegiate culture and continuing education programs that bring the members access to the latest data and the best practices from leading Angel communities all over the world and adapt them to the Australian context.

One of the core strategies of successful start-up investors is to co-invest with other, likeminded investors. This creates a stronger pool of financial support within the shareholder base and delivers a deeper, broader set of intellectual capital to assist the companies succeed. Melbourne Angels routinely syndicates with other Angel groups in Australia, New Zealand, the USA and elsewhere.

Performance

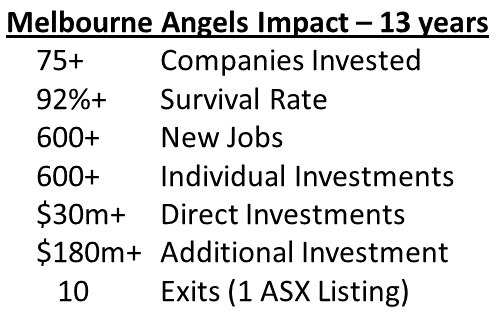

Melbourne Angels has invested in over 75 companies since 2007. Of those 7 have been acquired, one has been listed on the ASX and two have shutdown. They represent an aggregate total of ~$30m invested by our members which has attracted a further ~$180m into those companies. Our investments have supported the creation of over 600 new, highly skilled jobs in Australia.

Our members have enjoyed returns as high as 34x their investment capital from Angel investments they’ve made in Australian startups.